Garage Liability Insurance in Moreno Valley, CA

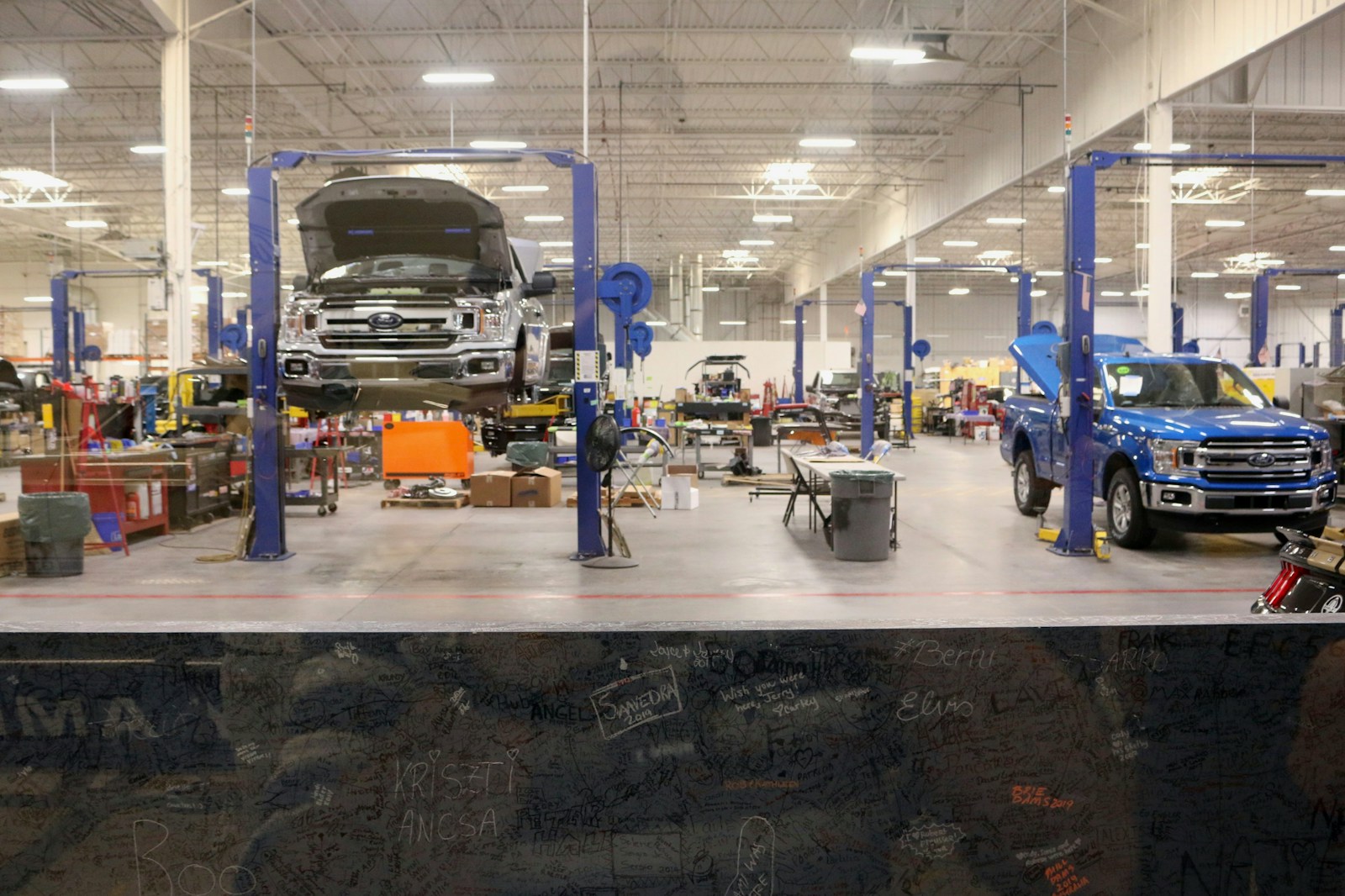

Garage liability insurance is a crucial form of protection for businesses operating in the automotive industry. This specialized insurance coverage is designed to shield businesses from liability situations when working with vehicles. Whether it’s a dealership, auto repair shop, towing company, mobile car detailer, tinting service, custom part installer or valet parking service, garage liability coverage offers essential safeguards against the risks inherent in handling customers’ vehicles.

What Is Garage Liability Insurance?

Like commercial general liability insurance, garage liability coverage is crafted to safeguard businesses in the automotive sector, especially those engaged in automobile sales, servicing, repairs or parking. This insurance protects against third-party bodily injury and property damage claims that could arise on the business premises or due to its activities.

What Is Garage Keepers Liability Insurance?

Garage liability policies are intended to protect the general business operations of a garage. Conversely, garage keepers liability insurance is crafted to protect customer vehicles while they’re in the possession of the business. For instance, if a garage is burglarized and a customer’s car is vandalized, garage keepers liability may pay for the car’s damages.

What Does Garage Keepers Liability Insurance Cover?

Garage keepers liability insurance typically covers the following:

- Damage to customers’ vehicles—This coverage protects against damage to customers’ vehicles while they are in the care, custody and control of the insured business. This can include damage caused by fire, theft, vandalism or accidents that occur on the business premises.

- Collision coverage—Garage keepers liability insurance may also cover damage to customers’ vehicles caused by collisions, whether on the business premises or while the vehicle is being transported or driven by an employee.

- Comprehensive coverage—Comprehensive coverage extends protection to damage caused by noncollision events, such as theft, vandalism, fire or severe weather.

It’s important to note that both garage liability and garage keepers liability insurance usually have coverage limits and may have applicable exclusions or conditions. Contact [email protected] to discuss your insurance needs today.